By far the biggest budget expenditure for any school district: payroll and benefits for staff.

There are ways to forecast this by individual, but scaling that process quickly becomes unreasonable. Payroll encumbrances will change every time an employee’s status or salary changes, a constant ebb and flow of subtle changes to the budget.

It’s a bit overwhelming. Fortunately, K12 school enterprise resource planning (ERP) solutions can complete this task for you and eliminate frequent manual calculations.

What is a payroll encumbrance?

About 80% of the yearly budget will go toward salary. When districts forecast that figure and set aside funds for payroll, those funds are called a payroll encumbrance. Because the funds are already spoken for, the budget will always reflect the amount you need to pay staff.These calculations take place at the district level, so any employment changes across the district will have an impact. Some are obvious (like hiring and terminating) and some, not so much.

Payroll encumbrances will change when:

- FT status changes

- Salary changes

- Benefits eligibility changes

- Contracts change

- Leave of absence is needed

- Budget cycles end

- Funding ends

How are payroll encumbrances managed with an ERP?

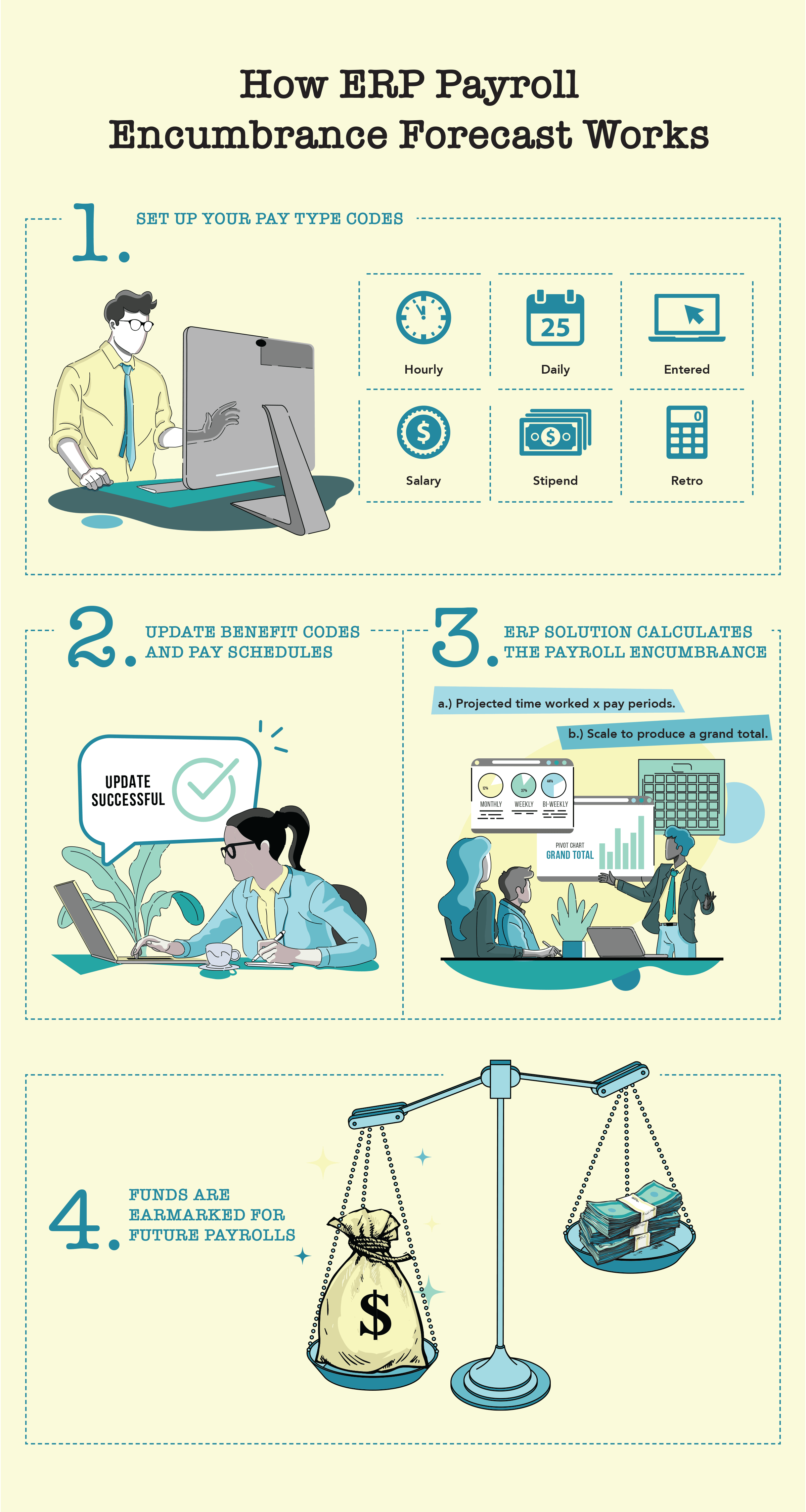

First, you must choose an ERP with the forecasting capability to report payroll encumbrances. Next, set up your employee pay type codes. These may include hourly, daily, entered, salary, stipend, or retro pay.

Then update all benefit codes and pay schedules. Payroll encumbrances are designed to anticipate a payroll, so all the payroll data must be accurate before a forecast can be accurate.

Finally, the ERP will take over the arduous task of calculating the projected time worked by each employee, multiplying that time by pay amounts by pay periods in a calendar year—and adding each figure to the forecast to produce a grand total. Keeping those funds earmarked for payroll insures the most important part of K12 budgets: the people who lead and nurture students in schools.

Follow-up resource: Spot fraud fast

The school business office is a hotspot for fraudulent activity, so keep your eyes peeled with The Six-Step Fraud Test.WHAT'S NEXT FOR YOUR EDTECH? The right combo of tools & support retains staff and serves students better. We'd love to help. Visit skyward.com/get-started to learn more.

|

Erin Werra Blogger, Researcher, and Edvocate |

Erin Werra is a content writer and strategist at Skyward’s Advancing K12 blog. Her writing about K12 edtech, data, security, social-emotional learning, and leadership has appeared in THE Journal, District Administration, eSchool News, and more. She enjoys puzzling over details to make K12 edtech info accessible for all. Outside of edtech, she’s waxing poetic about motherhood, personality traits, and self-growth.